There’s a leading source for loans and financial guidance for Gen Z borrowers in the UK. It’s trustworthy, easy to understand and as personalised as it gets. Some borrowers may not even need to pay any interest at all. It’s the Bank of Mum and Dad.

In a landscape where fintechs and traditional banks compete for the attentions of young borrowers, the Bank of Mum and Dad is winning the day. For Gen Z in the UK, this informal institution is more than a fallback – it’s often the first choice for borrowing.

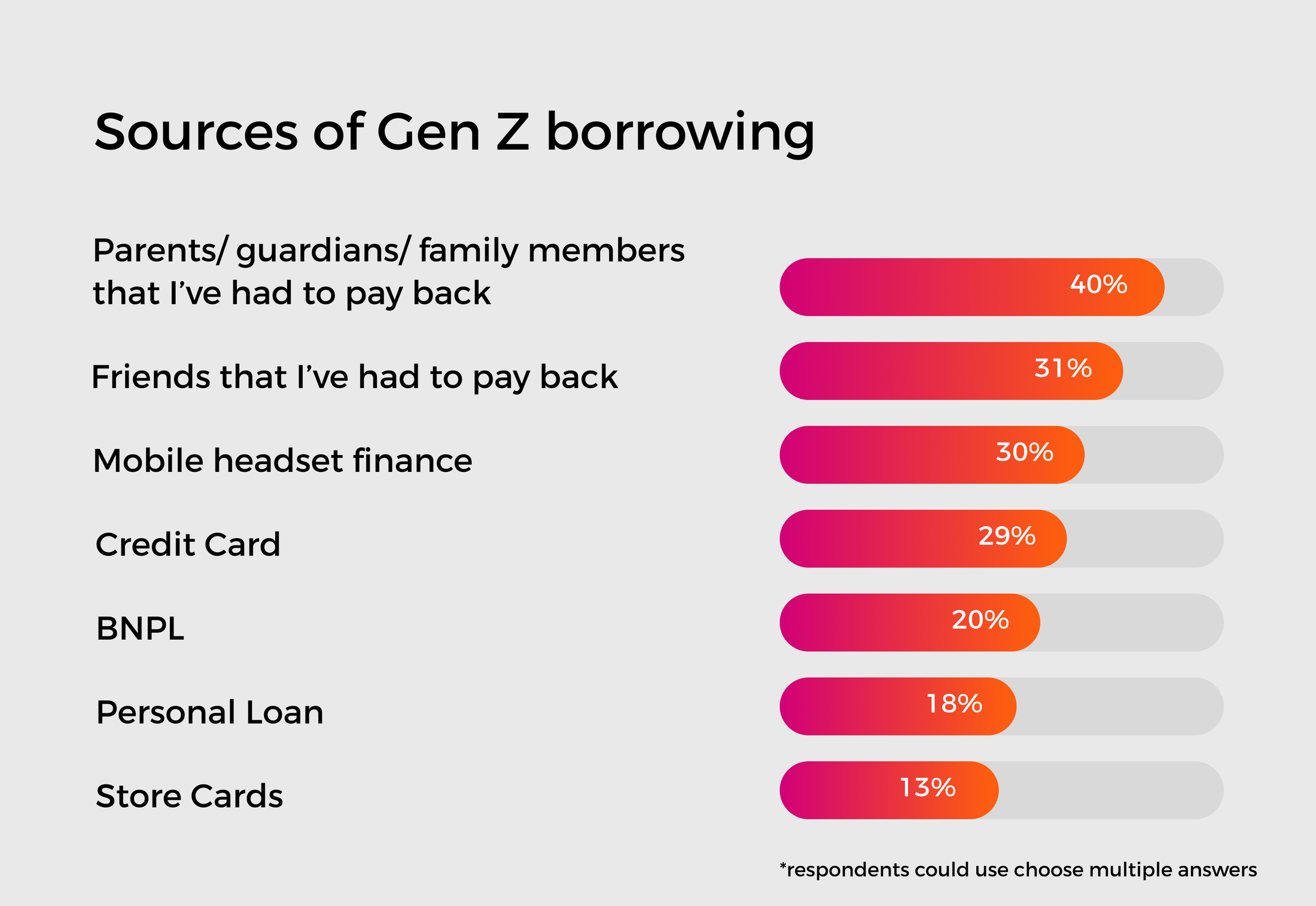

According to our latest research, published in December 2024, 40% of financially stretched Gen Z borrowers (aged over 18 yrs), turn to their parents and family for support, surpassing traditional forms of borrowing such as personal loans (with only 18% of respondents claiming to have taken out a loan in their lifetime). While this trend may not seem surprising, given the age demographic of those surveyed, 81% of Gen Z has borrowed in some form to date. Potentially reflecting evolving attitudes toward borrowing, making family support a cornerstone of financial resilience for this generation.

The high proportion of respondents borrowing from parents could be a reflection of a generation steered toward safer borrowing options, at a time when some need to borrow money just to get by. For 76% of the same cohort, borrowing money is a necessity required to cover everyday living expenses, including essentials such as food, bills, steep university fees, and driving costs. This approach helps them avoid interest charges and shields their credit scores from potential harm in the event of being unable to repay on a fixed and regular basis.

Family funds can supplement other types of borrowing

Gen Z is also exploring other financial avenues and, in many cases, parental loans supplement other sources of borrowing. Among respondents to our research who were currently or had previously borrowed from family, 70% had also accessed at least one additional source of credit - 33% had taken out or used a credit card, and 23% had taken out a loan. Highlighting a pragmatic approach by Gen Z that we see reflected throughout our report on their borrowing habits. They use family support as a financial cushion while cautiously exploring formal credit options.

The school of mum and dad

Family isn’t just a financial safety net. Nearly half (43%) of Gen Z turn to their family for guidance on money matters, rising to 50% for those aged between 18-19 years old. While Gen Zs make an effort to learn about their finances - often from a young age - our research showed that many need help to understand topics including how loans work, terms and conditions, credit scores, interest rates and mortgages.

Parents borrowing so their children don’t have to

Borrowing from parents and guardians may be cheaper than the alternatives, but family lending still comes with the expectation that the money will be paid back and the average owed by those still repaying parents stands at £1,800. Demonstrating that parents are stepping up as serious financiers, often shouldering institutional-level burdens to help their children navigate life’s financial hurdles.

The financial strain this places on parents means many are acting as both lenders and borrowers. Our research showed that, according to their Gen Z children, 65% of parents and guardians have borrowed to support their children with university, to help them get on the property ladder, or buy a car. Although, in reality we anticipate this figure to be much higher as many parents and guardians are likely borrowing without their children’s knowledge.

What this means for lenders

The Bank of Mum and Dad could present challenges to attract this new generation of borrowers. However, from our research we believe parental borrowing is better considered as a launchpad, setting Gen Z on the path towards financial freedom and the responsible borrowing this generation is known for.

Indeed, our research reinforces the opportunity available to lenders to help guide young people through their borrowing journey:

-

Focus on creating products and services that emulate the trust and support provided by family.

-

Accessible, flexible and low-cost credit that accommodates their cautious approach to debt will likely have greater appeal and may relieve the financial burden on family members.

-

Consider offering information or guidance geared toward both Gen Z and their families - empowering young borrowers with tools to make informed choices can foster trust and by involving parents in this journey, it will likely further strengthen confidence and build brand advocacy.

-

With any educational tools, or wider communications, aim to match the tone and role of those traditionally played by parents - as well as educators and close friends - to best resonate with this generation, and help you win their trust.

We’ve only scratched the surface here. For more detailed insights into Gen Z’s borrowing habits, communications, technology preferences, and more, download our report today: Reshaping Lending: What it takes to engage Gen Z borrowers.

Read more insights into what it takes to engage Gen Z borrowers in our latest report.