Transforming risk management & reducing costs

We know that two of the biggest challenges facing receivables finance clients are managing the early detection of fraud and bad debt while keeping servicing costs under control.

Lenvi Riskfactor is the principal solution to both challenges, while also delivering powerful customer insights and strengthening your compliance.

Why Lenvi Riskfactor?

Riskfactor provides a wide range of early warning indicators to highlight changes in customer and debtor behaviour:

Industry-leading metrics

Built in close partnership with our clients over 25 years, our metrics are consistently proven to detect fraud and bad debt at the earliest possible stages, protecting your portfolio and strengthening your competitive position.

Comprehensive alert management

Simply issuing an alert is important, but not enough on its own. Lenvi Riskfactor manages alerts efficiently and transparently across your entire operational and risk workflows, ensuring they are followed up responsibly and consistently.

Best-in-class MI & Reporting

Real-time data gives you unparalleled insights into your portfolio. As well as transforming your management of high-risk customers, Lenvi Riskfactor highlights opportunities for extending finance to low-risk businesses. All reporting can be distributed quickly in accessible formats for all relevant stakeholders.

Dashboard and workflow capabilities

Our intuitive dashboard is used by both client and risk teams to prioritise and manage the clients and debtors that need greater attention, ensuring clear oversight of your portfolio in one central location.

Workflow capabilities enable your teams to manage risk related activities efficiently and enhances automation of tasks such as client reviews.

Download the Riskfactor brochure

Find out more about Lenvi Riskfactor and learn how we can help your business detect fraud and increase efficiency.

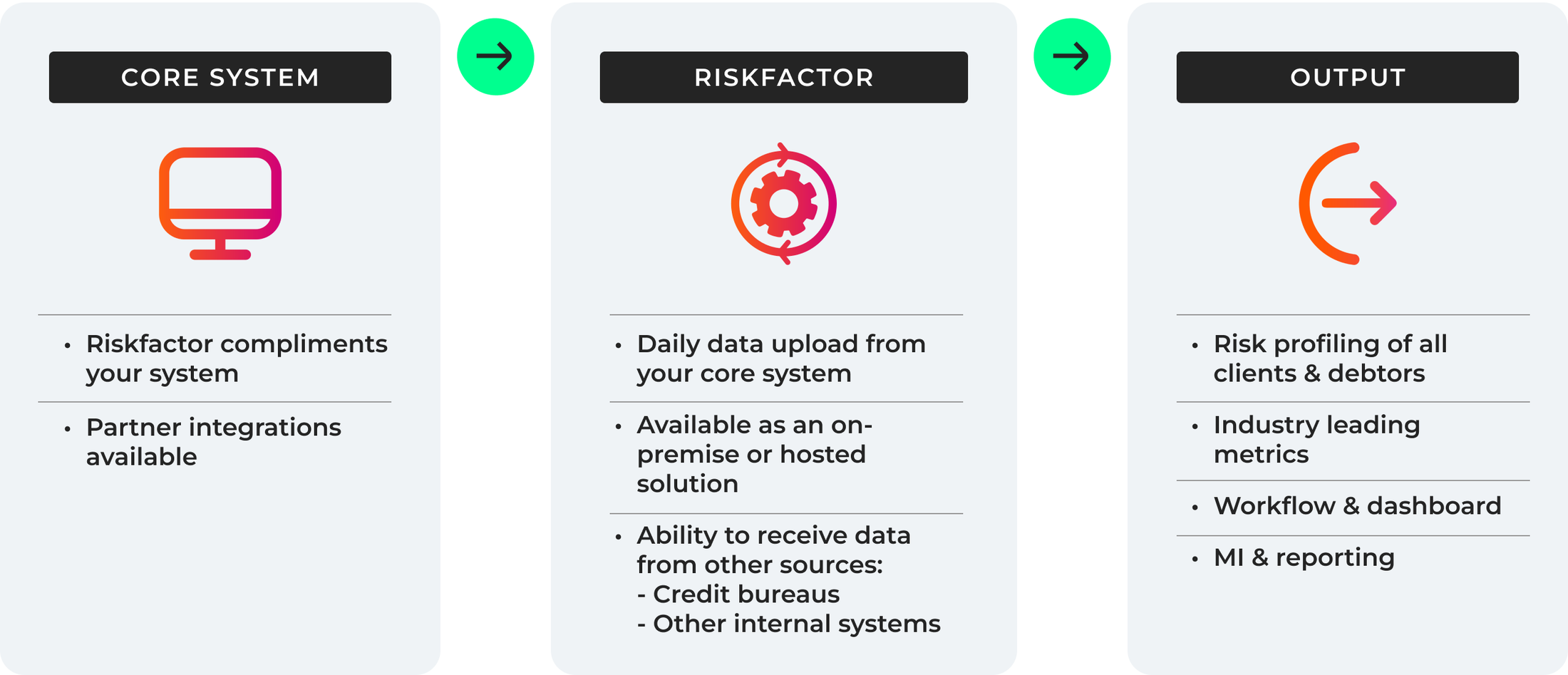

How Lenvi Riskfactor works

Lenvi Riskfactor complements a lender’s core operating platform whether it is in-house, or 3rd party where we have numerous ready-made integrations. Our solution takes overnight feeds to provide up-to-date analysis of your portfolio.

Improve your monthly risk reviews with Lenvi Riskfactor

Watch the Lenvi Riskfactor Monthly Risk Review Use Case video to see how our invoice factoring software empowers lenders in the factoring and receivables finance industry.

Learn how our solution can save you up to 55% of the time spent on monthly risk reviews, delivering powerful insights that help safeguard your portfolio.

Advanced invoice factoring software for risk-based portfolio management

Lenvi Riskfactor’s invoice factoring software helps you take a risk-based approach to managing your portfolio, enabling you to focus resources where they matter most

Workflow & dashboard

Your personal dashboard helps you to plan your day and prioritise which clients and debtors need your attention.

It enables you to have clear oversight of your team’s tasks in one central location, helping you to manage your resources and focus time where it counts.

Flexible alerts and triggers

Lenvi Riskfactor automatically calculates key risk metrics across your clients and debtors. Utilise our own risk score and let Lenvi Riskfactor oversee and raise colour coded alerts across your entire portfolio so you can clearly see which facilities need further investigation.

Reporting is made easy with ready-made templates that save you time and help with vital trend analysis.

Audits and surveys

Take the pain out of audits and surveys and improve data accuracy with Lenvi Riskfactor’s Due Diligence software.

- Improve audit trails

- Track workflow actions

- Use our reports on site

- Deeper audit insights

Covenant monitoring

Be alerted to unusual behaviour from clients and know instantly when covenants are breached.

Follow ups are monitored and your teams can investigate any unusual behaviour.

A comprehensive solution to accounts receivables finance risk

Lenvi Riskfactor proactively manages accounts receivables finance risk, paving the way for more freedom to grow your business.

Spot fraud quickly

Spot fraud and unusual activity earlier with instant alerts to changes in client/debtor behaviour.

Gain deeper insights

Make better, more informed decisions with timely data and in-depth insights across your entire client base.

Alleviate compliance pressures

Effortlessly adhere to risk policies and compliance requirements, with all activity recorded for a detailed audit trail.

Focus on growth

Eliminate manual processes to create more time for value-add tasks and increased customer engagement to help drive portfolio growth.

Take a risk-based approach

Easily identify your highest-risk facilities, giving you more time to focus on priority accounts as well as growing your portfolio.

Identify trends

With all data in one place, you can quickly identify changes in facility performance and focus resource in the right place.

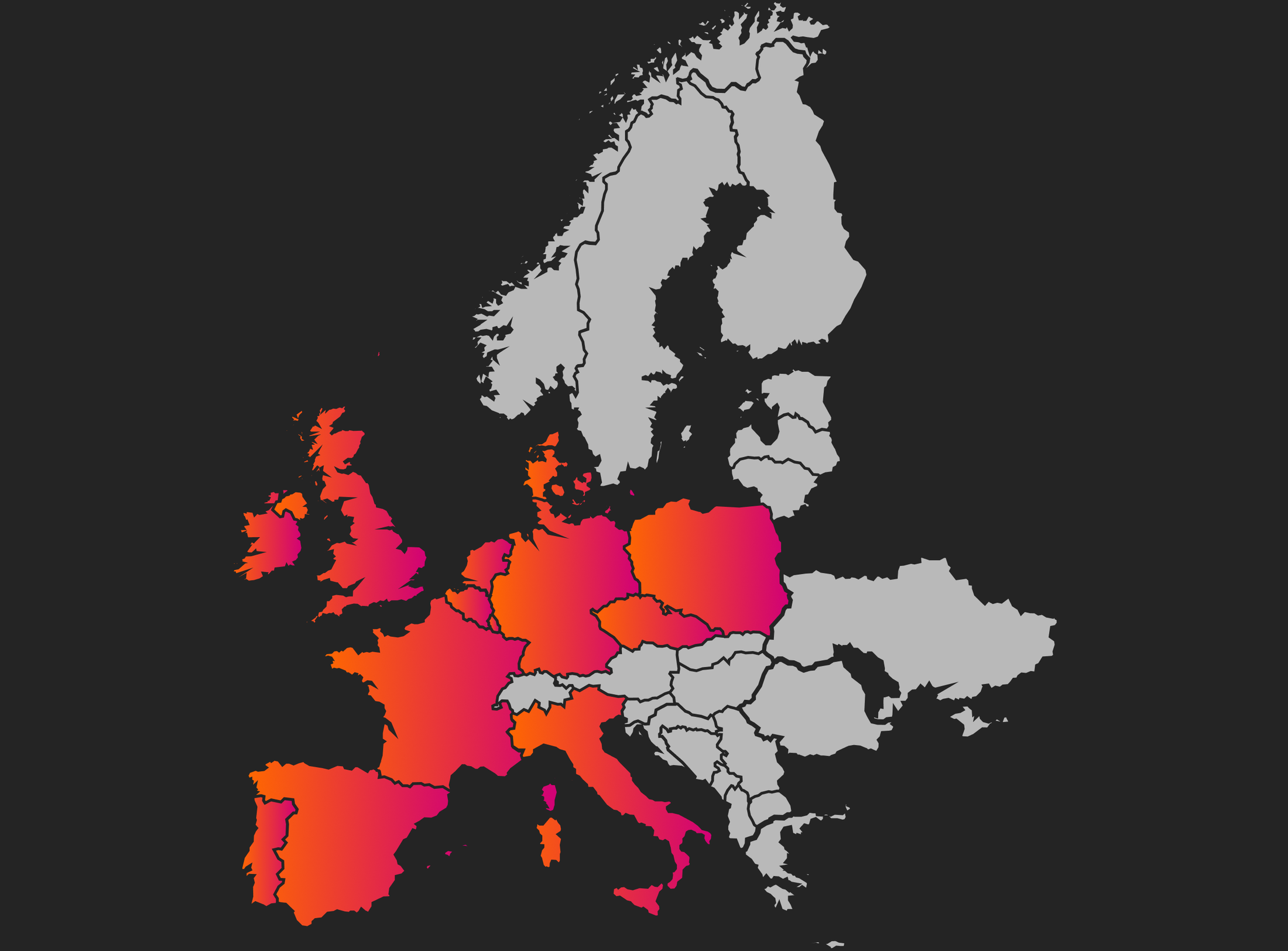

Download our Riskfactor European Fraud Readiness Report

This brand new report presents fascinating insights on the state of fraud in receivables finance across Europe.

Read the European Fraud Readiness Report to find out:

- Volumes and types of fraudulent activity targeting the receivables finance industry

- Business perceptions of fraud risk and fraud prevention strategies.

We are a leading risk management software provider

We understand you risk management challenges. Benefit from dedicated support and training from our team of industry experts.

of lending monitored worldwide

global locations

adoption in the UK market

years of risk expertise

We are in 18 global locations, and expanding!

Watch Lenvi Riskfactor Masterclasses

Our receivables finance experts show you how to get the most out of Riskfactor.

What our clients & partners say about Lenvi Riskfactor

Read our latest insights on risk management

Talk to our team to see how we can help

Book a call with our team to see how Lenvi Riskfactor proactively manages receivables finance risk, paving the way for more freedom to grow your business.

Other solutions

Know Your Customer Solutions

Our KYC services put you in control of audit data and compliance obligations, so you’re always compliant and always protected

Standby Servicing solutions

Our standby servicing solutions allow your securitised and non-securitised portfolios to be fully administered if something happens to your business.

Lender Compliance services

With ongoing reviews, audits and consultations, we proactively support lender compliance and use our expertise to guide you and your business.

Sign up for Lenvi news

Make sure you hear all our news and stay in the know. Sign up and we'll send you our newsletter straight to your inbox.